Feedstocks Used for U.S. Biodiesel: How Important is Corn Oil?

AgMRC Renewable Energy & Climate Change Newsletter

April 2013

Dr. Robert Wisner

Dr. Robert Wisner

University Professor Emeritus

Department of Economics

Iowa State University

rwwisner@iastate.edu

The 2007 Energy Independence and Security Act (EISA) (1) provides flexibility for the EPA to increase the biodiesel mandate from the minimum 1.0 billion gallons that is specified for 2012 and later years. Biodiesel meets the requirements for advanced biofuel and is the one major domestically produced source of advanced biofuel that is currently available in large commercial volumes. (2) With the much slower emergence of cellulosic biofuels than Congress had anticipated when it passed the EISA and the rapid ramping up of the advanced biofuel mandate, biodiesel has a potentially very important role in meeting government mandates. Cellulosic biofuels are considered to be advanced biofuels and were originally intended to supply a major part of the EISA 2.75 billion gallon advanced biofuels mandate for 2013. That EISA mandate rises to 5.5 billion gallons in 2015.

To put this mandate in perspective, the proposed 2013 advanced biofuels mandate is equivalent to about 21% of U.S. 2012 corn starch ethanol production. The 2015 mandate increases to the equivalent slightly more than 40% of the 2012 U.S. corn starch ethanol production. A very modest amount of commercial cellulosic biofuel production is expected to emerge in a few plants next year, but the quantity appears certain to be far below the EISA’s advanced biofuels mandates. If so, biodiesel may play a greatly increased role in meeting the nation’s advanced biofuels mandates in the intermediate years before the emergence of a large commercial cellulosic biofuel industry. The future role of biodiesel in meeting advanced biofuels also will depend on how quickly a way can be found to increase the level of the ethanol blend wall. Unless it is increased, the blend wall will limit the size of the market that is available for an emerging cellulosic ethanol industry and will make it necessary for the increasing advanced biofuels mandates to be filled with other fuels.

If biodiesel is required or expected to fill a substantial part of the increased advanced biofuels mandate, it is important to examine the sources of feedstocks used for biodiesel production. The experience of the corn ethanol industry is a caution for biodiesel producers. During the early years of the rapid expansion in corn starch ethanol production, corn was priced at or below $2 per bushel and was a very economical feedstock. But as demand increased, supplies tightened and the feedstock price increased sharply and depressed profit margins. Similar risks could occur in the biodiesel industry as well as in the emerging cellulosic biofuels industry.

In the last few years, many ethanol production facilities have added technology to remove corn oil from distillers grains and solubles, thus generating an additional income stream to help offset depressed profit margins. The vast majority of plants that have begun removing corn oil in the last few years use end-stream technology. End-stream technology produces corn oil that typically is not suitable for the food industry. Rapid expansion in use of this technology has resulted in a substantial increase in production of lower quality corn oil. The main uses of this added corn oil supply are for additional energy in livestock and poultry rations and for biodiesel production. For 2013, EPA has proposed increasing the basic biodiesel mandate by 28% from last year. If biodiesel would be expected to supply its proposed higher mandate and one-half of this year’s proposed 2.75 billion gallon advanced biofuels mandate, the combined increases in mandates would require a very large increase in feedstocks. Supplies of presently used feedstocks currently are quite tight.

In this article, we look at amounts of various feedstocks that are being used for U.S. biodiesel production. The Energy Information Administration in the U.S. Energy Department provides data on these feedstocks only for the past three years, so a lengthy historical analysis is not available. Biodiesel production is a relatively young industry. It its initial years, the major feedstocks were soybean oil and animal fats.

Overview of U.S. Biodiesel Production

Biodiesel production in the U.S. emerged in the early 2000s with growing concern about the need for energy independence and reduced greenhouse gas emissions. Production facilities are now spread over a large geographic area, as Figure 1 indicates. (3) Thirty seven sates report have at least one biodiesel production facility. The top four states in biodiesel production capacity are Texas, Iowa, Illinois and Missouri, in that order. These four states have slightly over half of the U.S. production capacity. Texas has large petroleum refining capacity which fits well with its need for biodiesel to blend with petroleum-based diesel fuel. The other three of the top four states are at the center of the nation’s Soybean Belt and have large supplies of soybean oil available for biodiesel production.

The Energy Information Administration (EIA) reports the U.S. biodiesel production capacity at 2.13 billion gallons per year. (4) In its peak calendar year of production (2012), EIA data indicate U.S. produced 969 million gallons of biodiesel, which is equivalent to 45.6% of the currently reported industry capacity. Thus, the biodiesel industry appears to have substantial capacity to increase production in response to the proposed sharp increases in biodiesel and advanced biofuels mandates.

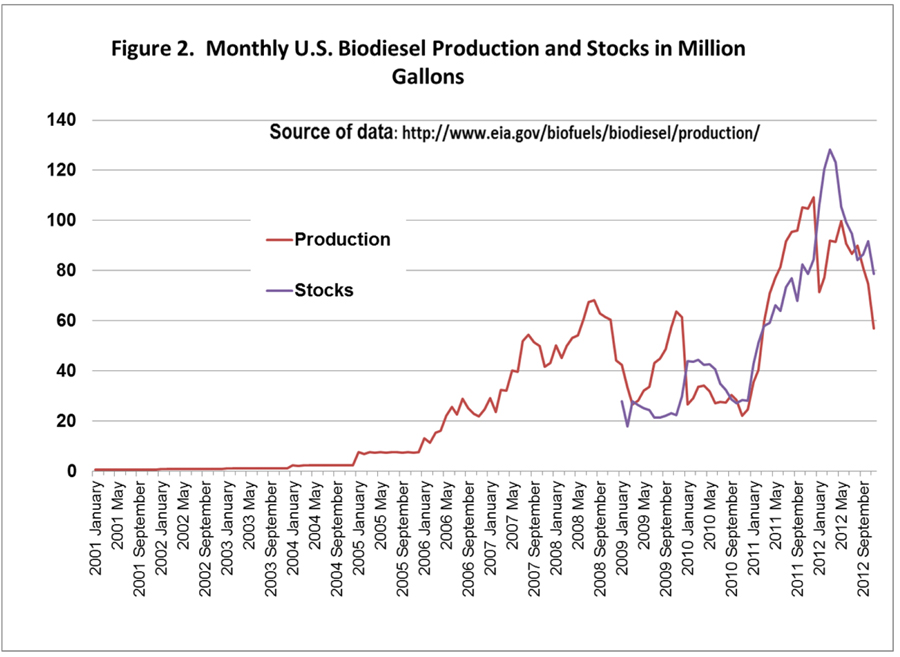

Figure 2 shows U.S. monthly biodiesel production since 2001 and reported biodiesel stocks. Production has fluctuated in a wide range and has been influenced by an off and on-again blenders tax credit as well as loss of the EU export market. In the last two years, stocks have increased substantially and at times have exceeded production.

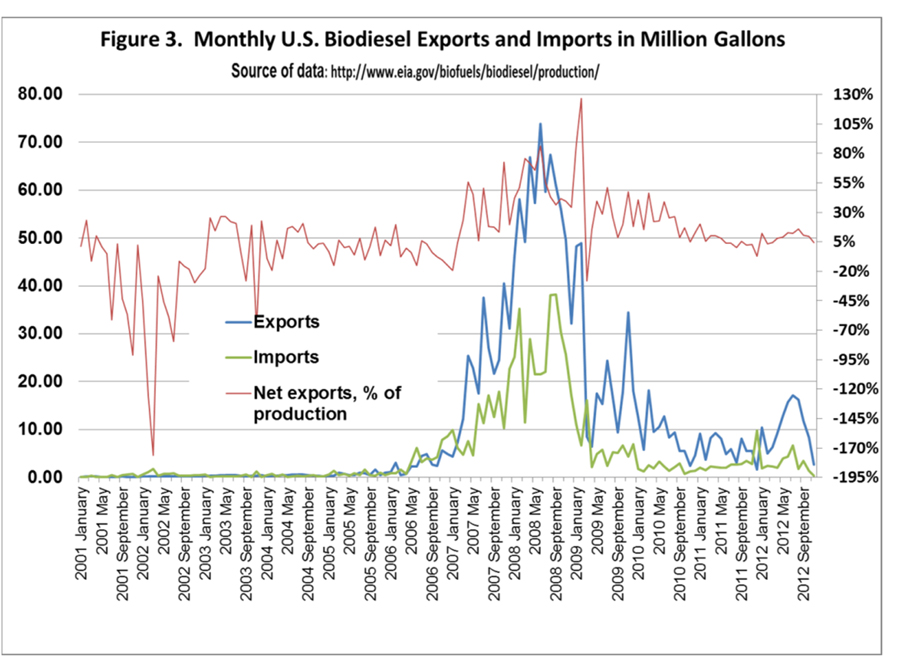

Figure 3 shows exports and imports of U.S. biodiesel. Exports were large during the 2007-2008 period before the EU implemented import tariff restraints on U.S. biodiesel, as the chart indicates.

Since February of 2011, net exports have ranged from a low of -7.5% to a high of 16% of total production. Net exports are shown on the right-hand vertical axis of the chart. The negative number at the low end of this range means U.S. at that time was a net importer, with net imports equal to 7.5% of that month’s production.

Major feedstocks used for U.S. biodiesel production

The U.S. Energy Information Administration (EIA) in the last three years has provided monthly data on the amount of selected feedstocks used for biodiesel production.

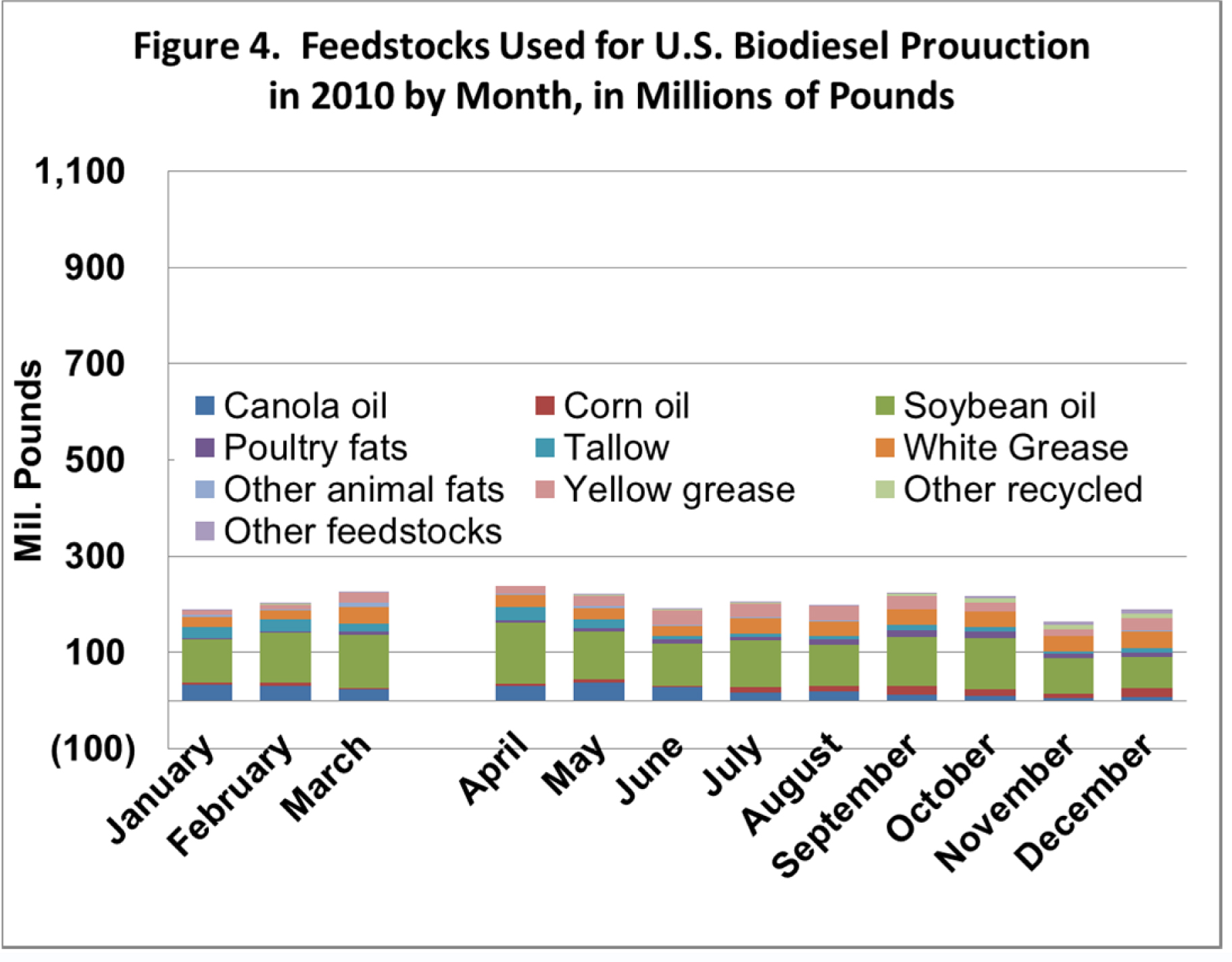

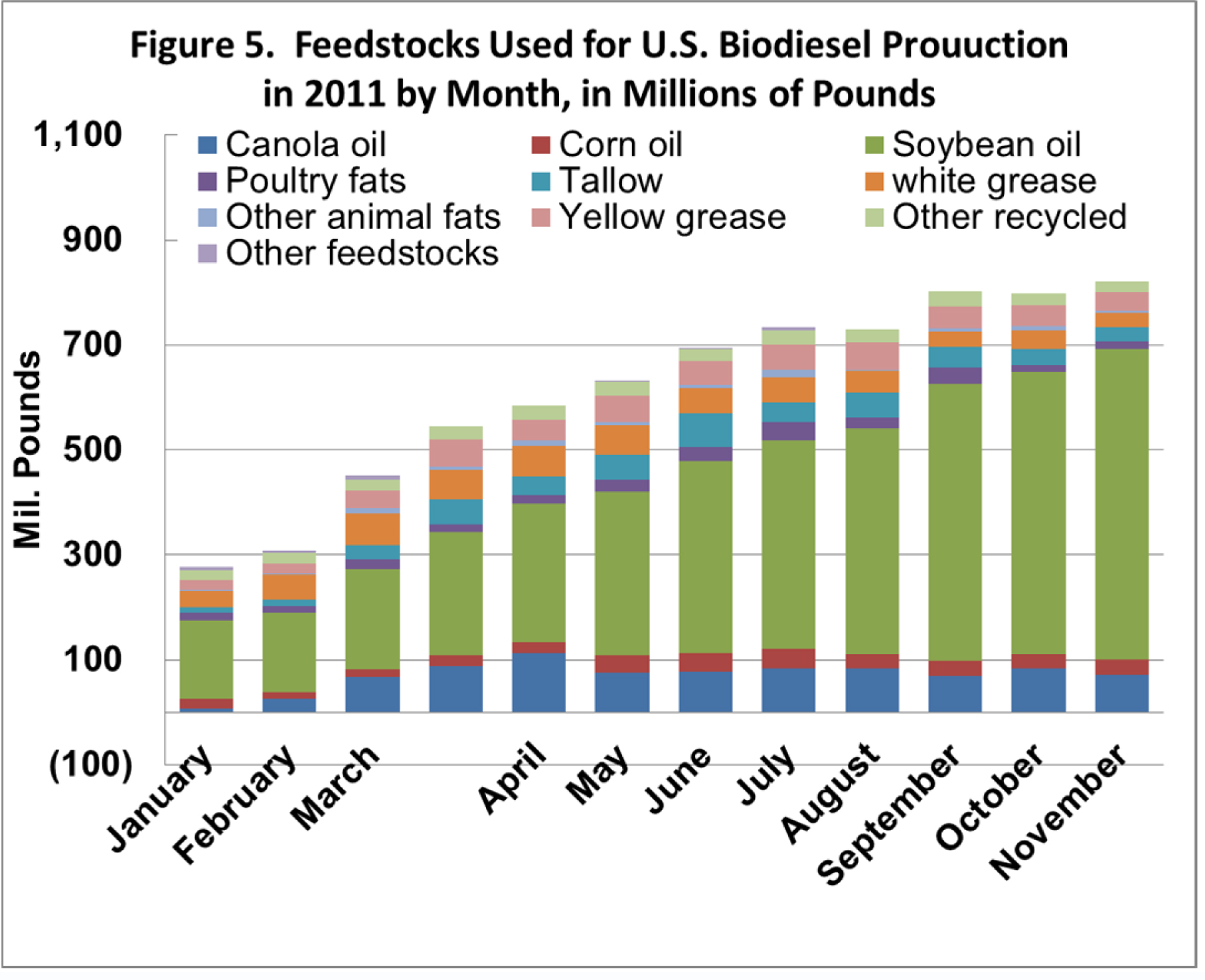

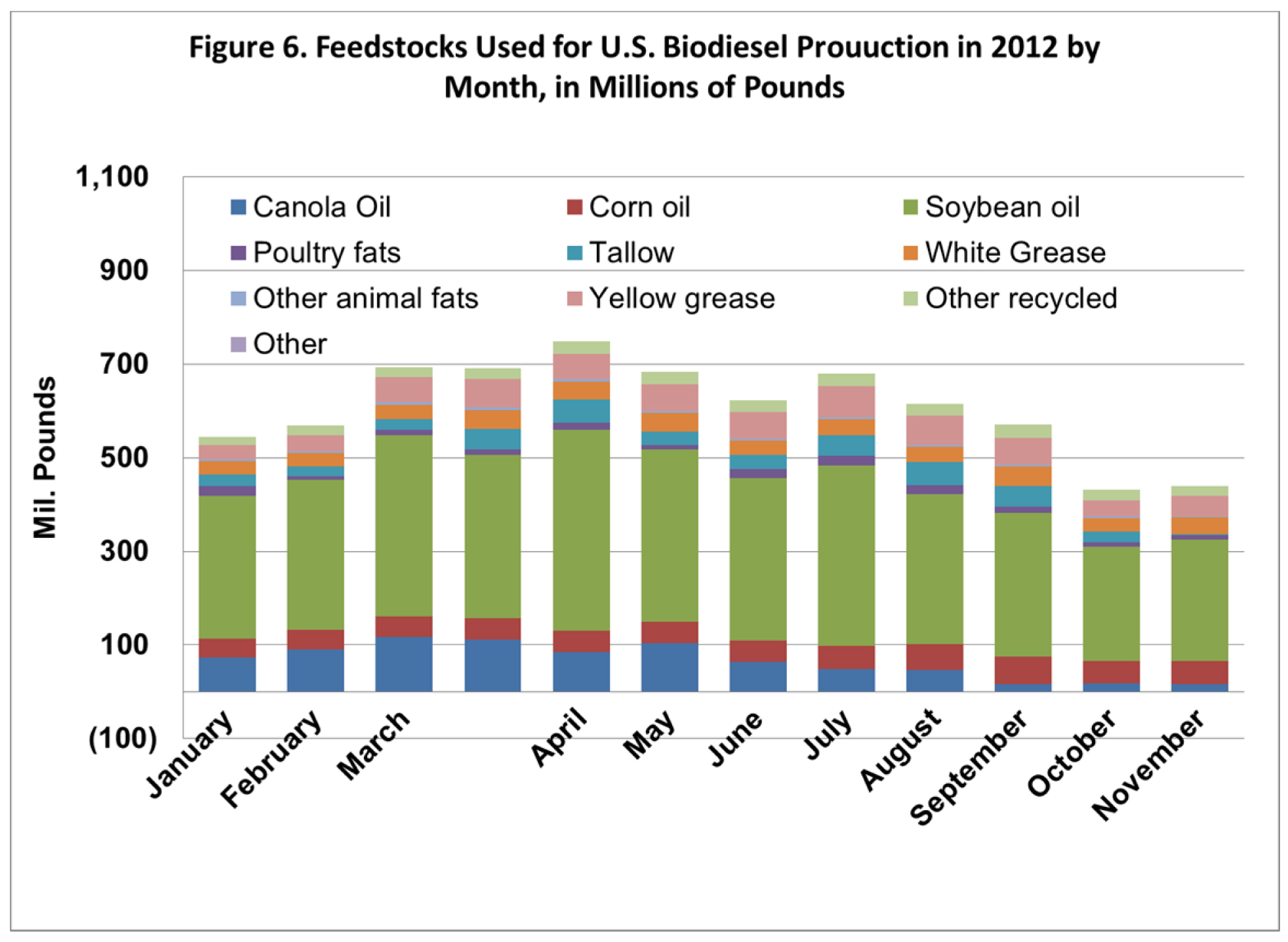

Feedstocks used in 2010, 2011, and 2012 are shown in Figures 4 through 6 below, in millions of pounds. EIA also lists cottonseed oil, palm oil and other vegetable oils as biodiesel feedstocks in their monthly data base but withholds the numbers to avoid disclosure of individual company data. It appears that use of these feedstocks may be very small. As Figure 2 above indicated, biodiesel production was much smaller in 2010 than in the following two years.

The same vertical scale is used in each of Figures 4, 5 and 6. As the biodiesel industry emerged, soybean oil was its dominant feedstock, accounting for more than half of the total feedstocks used in 2011 and 2012. Other feedstocks included canola oil, tallow, poultry fats, yellow grease, white grease, and a very small amount of corn oil. Yellow grease is a term used for recycled cooking oils.

Figures 5 and 6 reflect a substantial recovery of biodiesel production in 2011 and 2012 after adjustment to the loss of the EU export market. Most of the feedstock used for the increase in production was soybean oil, as Figure 5 clearly indicates. Use of canola oil for U.S. biodiesel gradually declined during the last two-thirds of 2011 after reaching a peak in April. The decline in its use for biodiesel may partly reflect its increased use as a partial replacement for soybean oil in the food industry.

With much narrower profit margins for ethanol production than in early years of the industry’s expansion, a sizeable number of ethanol plants began adding end-stream technology to remove corn oil from distillers grain and solubles. The oil produced from this process is useable largely as a biodiesel feedstock or as an energy source in livestock and poultry rations. As this type of corn oil production increased, its use in biodiesel production gradually increased but remained a much smaller portion of the total feedstocks than soybean oil.

Figure 6 indicates that biodiesel production trended downward beginning in late spring of 2012. Most of the decrease was accommodated by reductions in use of canola oil and soybean oil. Loss of the biodiesel tax credit likely was a major reason for the decline, along with rising feedstock costs in the summer and early fall. Even with declining production, soybean oil remained the dominant feedstock by a large margin. Use of corn oil and yellow grease as feedstocks gradually increased in 2012 but remained a relatively small part of the feedstock mix.

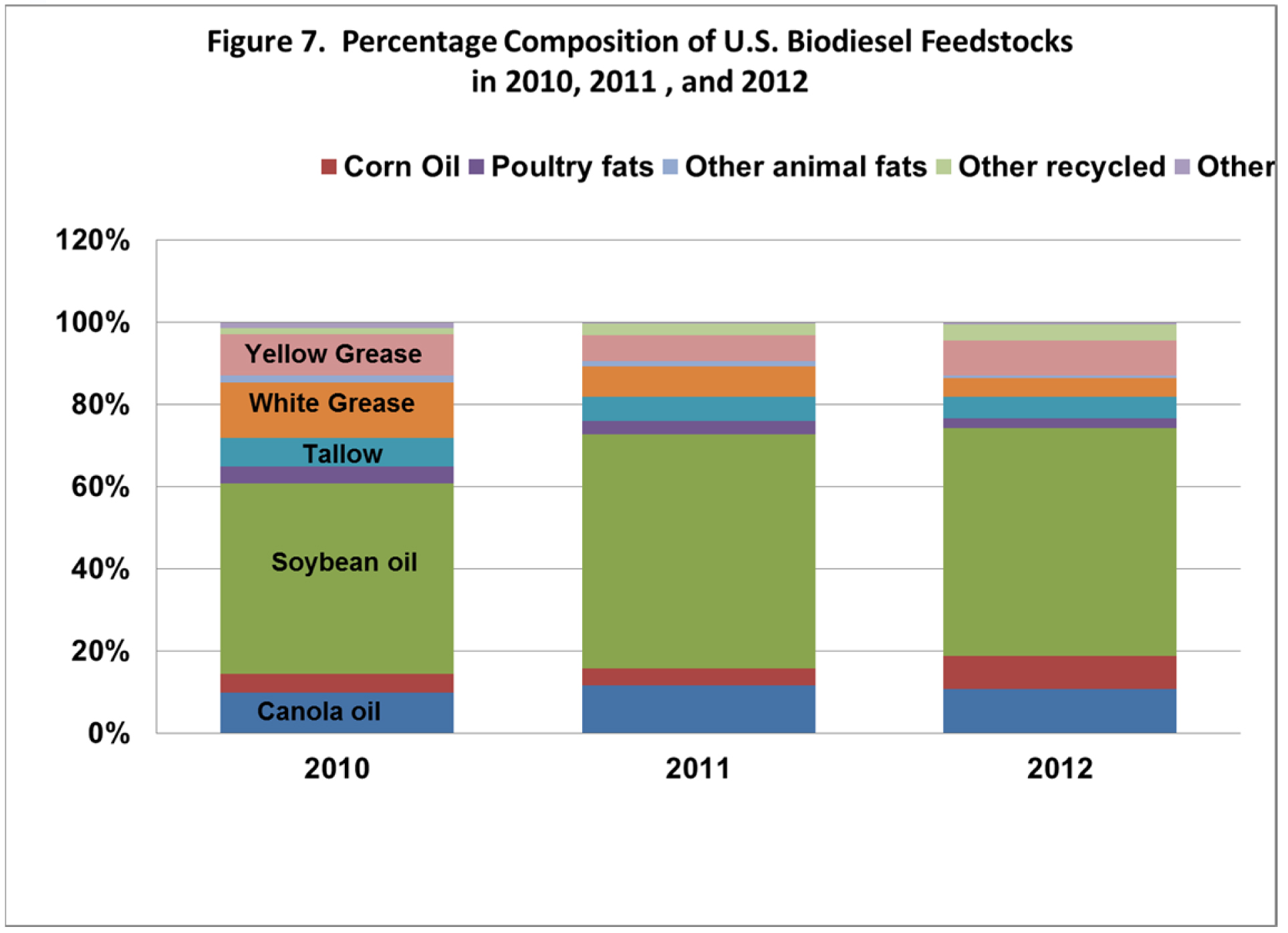

Figure 7 shows the relative shares of the various biodiesel feedstocks on an annual basis for 2010 through 2012. Soybean oil accounted for 55.5 to 57 percent of EIA’s reported feedstocks used for biodiesel production in 2011 and 2012. However, its total volume used for biodiesel fluctuated more than those of other feedstocks when total biodiesel production fluctuated. Corn oil accounted for 4.6 to 7.9 percent of the total feedstocks. Thus, it is significant as a biodiesel feedstock but still has only a small share of the total biodiesel feedstocks. Yellow grease's share of the total fluctuated from 6.4 percent to 10 percent of the total feedstocks. White grease’s share declined from 13.6% in 2010 to 4.6% in 2012. Canola oil was the second-largest feedstock source for biodiesel production in 2011 and 2012, with 11.6 and 10.9 percent market shares respectively in those years. Trade sources indicate that because of tight supplies, use of canola oil for U.S. biodiesel will drop sharply this year.

Concluding Comments

Biodiesel production capacity is spread across numerous states although the largest share of production is in the petroleum-refining state of Texas and in the heart of the Corn and Soybean Belt where soybean oil is readily available as a feedstock. In contrast to its sister biofuel, corn-starch ethanol, biodiesel production has been erratic from year to year. Reasons behind the fluctuations in its production include off and on-again policies related to biofuels tax credits and loss of the formerly very large EU biodiesel market.

Soybean oil continues to be the dominant U.S. biodiesel feedstock by a large margin. It usually accounts for more than half of the nation’s biodiesel feedstocks. Canola oil’s market share of total feedstocks has been in a narrow range of about 10 to 12 percent of the total. Yellow grease in the last year has become the third largest U.S. biodiesel feedstock. Its share was slightly above that of corn oil. Despite a rapid increase in the number of corn-starch ethanol plants producing corn oil, its share of the total biodiesel feedstock market remains quite small.

Looking ahead to the future, the proposed large increases in 2013 biodiesel and advanced biofuels mandates could have a large positive impact on the biodiesel industry if feedstock supplies were more plentiful. (5) It is almost certain that a sizeable share of the increased feedstocks needed to meet the proposed mandates, if they are implemented, would be soybean oil. This year, that would create a major challenge because of very tight old-crop U.S. soybean supplies. Supplies of other feedstocks are limited and face alternative demands in the feed industry to provide additional energy during the very tight grain supply situation. Some have suggested importing palm oil for biodiesel production but a December 2011 EPA release indicates its studies found that biodiesel and renewable diesel from palm oil do not meet the life-cycle 20% minimum greenhouse gas reduction needed to qualify as a biofuel. (6)

References

1 U.S. Congress, Energy Independence and Security Act of 2007

2 Limited production of a few other alternative advanced biofuels may be available this year, as indicated by Environmental Protection Agency, 40 CFR Part 80 [EPA-HQ-OAR-2012-0456; FRL-9678-8],RIN 2060-AR43: Regulation of Fuels and Fuel Additives:2013 Renewable Fuel Standards. Also see “Real Fuels”, and Ron Kobrta, “KiOR ships first cellulosic diesel volumes from Miss. Biorefinery”, Biodiesel Magazine, March 19, 2013

3 Energy Information Administration, Monthly Biodiesel Production Report, December 2012,

4 Ibid.

5 For details on the mandates see R. Wisner, “EPA's Proposed Biofuels Mandates for 2013 - Challenges for the Biofuels Industry,” Renewable Energy and Climate Change Newsletter, Ag Marketing Resource Center, March 2013.

6 Environmental Protection Agency, Regulatory Announcement, “EPA Issues Notice of Data Availability Concerning Renewable Fuels Produced from Palm Oil Under the RFS Program”, Office of Transportation and Air Quality, EPA-420-F-11-046, December 2011.